Hull City Council and East Riding Of Yorkshire Council together had more than £1 billion of debt as of the end of the 2024/25 financial year, figures have revealed.

The majority of this comes from Hull City Council which saw its debt increase by £121m over the year which the authority says is down to “borrowing taken to fund the council’s capital expenditure”. Meanwhile, East Riding Council’s debt fell slightly over the same period.

The BBC Shared Data Unit has compiled data on each local authority’s debt at the end 2024/25, and compared it to figures from 12 months earlier. In East Yorkshire, the data shows that East Riding Council and Hull City Council have a combined debt of over £1.15 billion.

East Riding Council ended the 2024/25 financial year with almost £14,000,000 less debt than it had began the period with, the overall number having been reduced to £383,174,000.

This means that East Riding Council has £1,094 debt per resident. This figure is lower than the UK average of £1,791 per resident.

Hull City Council, on the other hand, has £2,848 debt per resident. In the same time frame which East Riding Council saw its debt fall, Hull City Council racked up an additional £121m, taking its total debt to £774,695,000.

Both councils have responded to the data. Julian Neilson, director of finance for East Riding Council said:

“To support long-term investment in vital infrastructure and public services, such as roads, council housing, public buildings, and other public spaces, the council uses borrowing as one of its key funding sources. This enables the council to spread the cost of major projects over time, similar to how homeowners use mortgages to finance the purchase of their property.

“Without borrowing, many essential improvements would be unaffordable, as councils do not receive sufficient upfront funding to cover large-scale investments. The council borrows money from the Government’s Public Works Loan Board, which offers the most competitive interest rates available to local authorities.

“During the 2024-25 financial year, while continuing to invest in infrastructure and public services, the council was able to make efficient use of its surplus cash balances to temporarily delay further borrowing. As a result, the council was able to reduce its overall debt by £13.9m, bringing total borrowing down to £383m by the year-end. East Riding of Yorkshire Council’s borrowing remains well within affordability thresholds, allowing us to invest in the future of our community while maintaining strong and responsible financial management.”

A Hull City Council spokesperson said:

“Hull City Council, in common with other local authorities, borrows money in order to fund investment in assets, including roads, pathways, bridges, libraries, museums, theatres, leisure facilities, and Council offices, to maintain and improve the city’s infrastructure and ensure services can be delivered to residents. In addition, Hull City Council owns around 25,000 social homes, which also require borrowing to fund investment. Many other local authorities no longer maintain their own housing stock, or have smaller numbers, which will obviously impact on debt statistics in comparison to other local authorities.”

“The increase in the year-end debt position reflects the borrowing taken to fund the Council’s capital expenditure in the last financial year. As reported to the Council’s Cabinet in July 2025, the Council invested £168M in its assets over the financial year, including £73M on its housing stock. This expenditure has been funded through a combination of borrowing, Government grants and capital receipts derived from the sale of assets. Loans are taken in line with the Council’s approved Treasury Management Strategy with the timing determined based on prevailing cash flow and interest rate projections.”

Across the UK councils owe a combined £122.2 billion to lenders, the data has found. The figure rose 7% from the end of the 2023/24 financial year.

Despite the figures for Hull and East Riding councils being considerable, they remain far lower than many others in the UK. Birmingham City Council has the highest amount of debt at £3.3 billion. However the council’s debt per person figure is similar to Hull’s at £2,875, whereas Hull’s is £2,848. The council with the highest debt per resident is Woking Borough Council with a staggering debt of £20,601 per person.

Wintry Conditions Grip Yorkshire Coast as Met Office Issues Multiple Weekend Weather Warnings

Wintry Conditions Grip Yorkshire Coast as Met Office Issues Multiple Weekend Weather Warnings

MP Meets with Council Over Yorkshire Coast Snow Response

MP Meets with Council Over Yorkshire Coast Snow Response

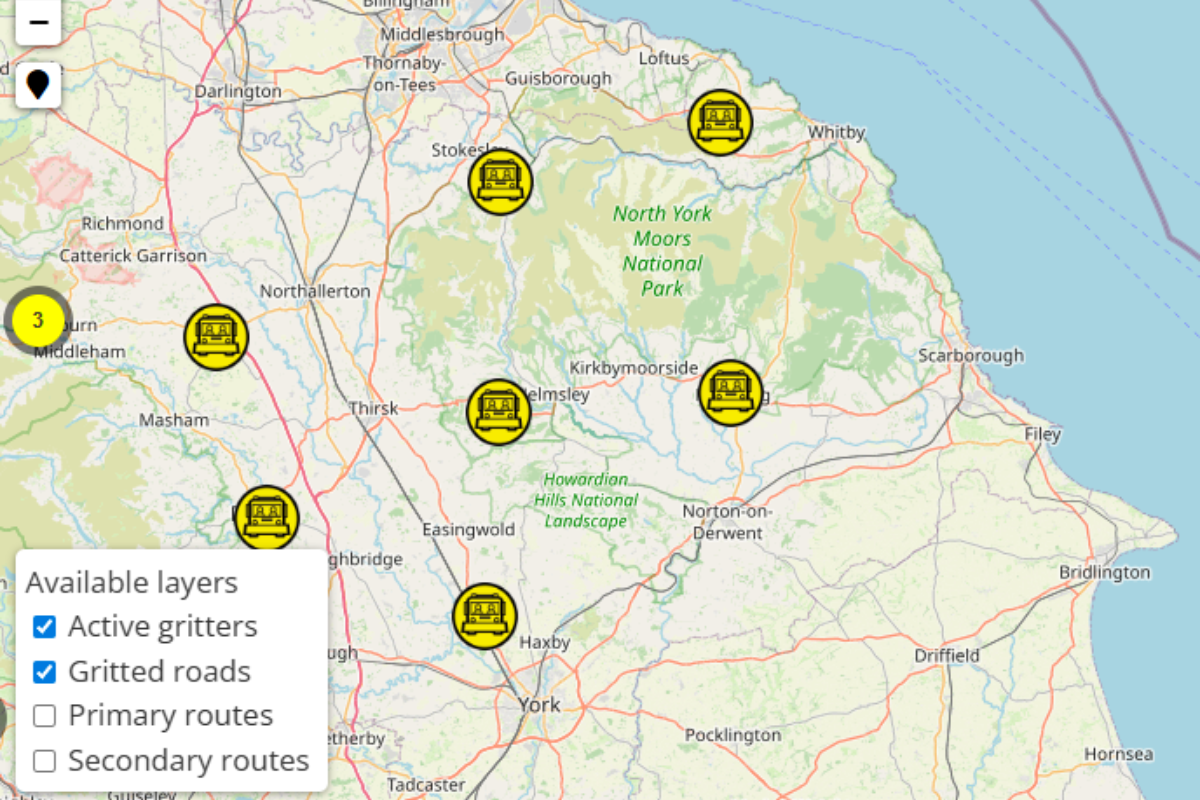

What Could be Better on a Cold Winter Night Than Tracking a Gritter?

What Could be Better on a Cold Winter Night Than Tracking a Gritter?

Scarborough Athletic Set For First Home Clash of 2026

Scarborough Athletic Set For First Home Clash of 2026

Whitby Town Want Workington Win To Kick Off New Year

Whitby Town Want Workington Win To Kick Off New Year

Yorkshire Coast Rugby Returns

Yorkshire Coast Rugby Returns

Olly Green Rejoins Bridlington Town on a Permanent Deal

Olly Green Rejoins Bridlington Town on a Permanent Deal

Pickering Town Face Wombwell Trip

Pickering Town Face Wombwell Trip

Scarborough Athletic Chairman Remains Resolute as Club Awaits Firm Date for Pitch Repairs

Scarborough Athletic Chairman Remains Resolute as Club Awaits Firm Date for Pitch Repairs

Concerns Over Pickering Sewerage

Concerns Over Pickering Sewerage

Record Low Smoking Rates Among Pregnant Women across Humber and North Yorkshire

Record Low Smoking Rates Among Pregnant Women across Humber and North Yorkshire

New Toll System for Humber Bridge

New Toll System for Humber Bridge

Comments

Add a comment